Table of Contents

Cloud infrastructure is the ultimate option for every IT company in 2021. This condition is due to digital transition changes exacerbated by remote work and the COVID-19 pandemic. Here’s a look at the top cloud providers stack up, the hybrid market, and the significant players in SaaS.

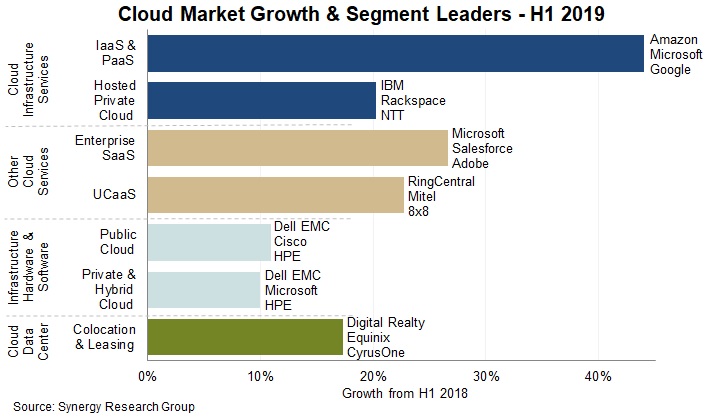

The demand for cloud computing is massive. New data from the Synergy study states that, through seven primary cloud services and technology industry groups, operators and vendors record sales of over $150 billion in the first half of 2019. A rise of 24 percent from the previous year.

As large as the cloud market has been, there is enough space for growth. Particularly when you know that Gartner is predicting $3.79 trillion in IT spending worldwide in 2019.

Top Cloud Providers

Take a closer look at the top 5 public cloud infrastructure providers in 2021. Here is a brief of Gartner’s information and statistics from the top cloud providers’ relevant sales results.

Amazon Web Services (AWS)

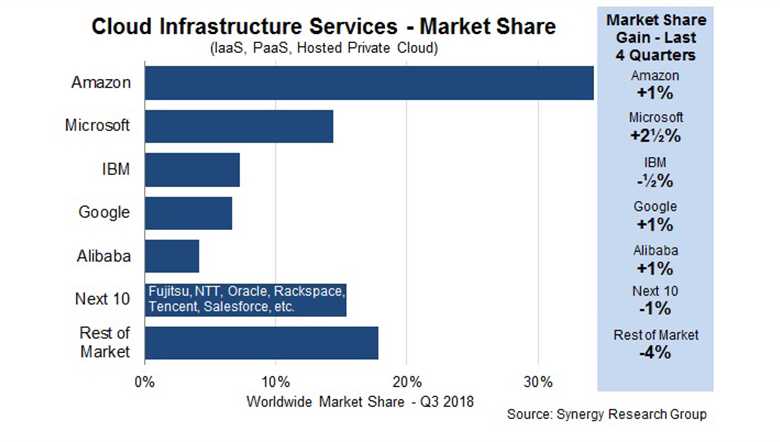

With nearly half of the world’s distributed cloud computing market, Amazon web services is a substantial market leader. In 2018, Amazon shared $15.4 billion in sales, a rise of 26.8 percent over the previous year. Carrying its supremacy in 2019, Amazon shared Q1 and Q2 total AWS sales of $16.1 billion, up 39% from H1 2018.

Microsoft Azure

With a market share of 15.5 percent, Gartner reports Azure’s annual sales of $5 billion and a rise of 60.9 percent in 2018, increasing Azure’s market share. However, having an accurate image of Microsoft’s share of the public cloud computing market remains a puzzle. As Microsoft continues to mask Azure’s revenue in a consolidated “commercial cloud business.”

In 2019, Microsoft looked poised to claim AWS market share, announcing H1 YoY growth of 70 percent in Azure sales. Overall, Microsoft’s Q1 and Q2 cumulative commercial cloud market sales are now estimated to be $20.6 billion, a 40% rise in H1 2018.

Alibaba Cloud

Owning 7.7 percent of Gartner’s public cloud market share, Alibaba has an annual turnover of $2.49 billion and a phenomenal rise of 92.6 percent in 2018. The Chinese e-commerce giant maintained its remarkable growth in 2019, accounting for cumulative sales of $2.2 billion in Q1 and Q2, a rise of 66%. This rise takes the company’s annual sales at the peak of more than $4 billion.

Google Cloud Platform (GCP)

Gartner projects the Google Cloud Infrastructure to have a 4 percent public cloud market share, with annual sales of $1.3 billion and a 60 percent rise in 2018. This year saw Google’s overtake of Alibaba, with Google’s CEO estimating $8 billion of cloud service sales on target. This situation has to be viewed keenly as Google mixes GCP revenue with its SaaS G-Suite service.

IBM

According to Gartner, IBM holds a 1.8 percent market share, which is an annual turnover of $577 million and a rise of 24.1 percent in 2018. Renowned mainly for its hybrid cloud offerings, IBM is poised to spice up the industry in 2019 by purchasing $34 billion from fellow IaaS provider Red Hat.

SaaS Players

Five leading suppliers dominate the SaaS market. Combined, these SaaS vendors account for 51% of SaaS’s total cloud market share.

Microsoft is leading the way, with a 17 percent market share and an unprecedented 34 percent average growth rate. Microsoft continues to capture market share, mainly due to its supremacy in the high-growth partnership segment.

Salesforce comes second with a market share of 12 percent of SaaS and an average rise of 21 percent. Consequently. Adobe comes with a 10% market share of SaaS and an annual growth of 29%. Next is SAP, which closes on the above vendors, with a 6 percent market share of SaaS and a yearly growth rate of 39 percent. These are the fastest of the top five vendors. Lastly, Oracle already has a market share of 6% and an average growth rate of 29%.

The next ten sellers account for another 26% of the SaaS market, with a recorded rise of 26%. These providers include Cisco, Google, IBM, ServiceNow, and Workday.

Salesforce

Salesforce’s goals are very evident. The business needs to allow its customers to use its data to have personal experience, market its cloud portfolio to you, and place its Salesforce Customer 360 initiative at the forefront of the technology environment. In 2020, Salesforce extended its scope to Work.com, a suite that would allow employees to return to the workplace after the COVID-19 pandemic.

The latest innovations illustrate Salesforce’s approach to investing in a slowdown. Salesforce also said that it would acquire Slack to link its numerous clouds.

Salesforce will need more clouds from its most prominent clients if it meets its $35 billion sales goal in fiscal 2025.

Salesforce’s latest lineup consists of clouds for integration, commerce, insights, marketing, service platforms, and sales. Service and sales clouds are the most mature, but some are growing high. Salesforce’s Einstein is an example of the AI functionality that is an upsell of the clouds. By the end of the day, Salesforce sees a potential addressable market of $168 billion. Work.com could add more to the list.

Adobe

Adobe’s cloud ambitions revolve around widening the user base and the potential addressable market as content and data converge rapidly. Adobe has become a well-established top cloud provider between content producers and advertisers. Still, a plan to concentrate on digital experience and data analytics would place it on a collision path with Salesforce, Oracle, and SAP in marketing.

For companies, Adobe’s strategy to significantly increase its overall addressable market can be positive, mainly if it uses the system as leverage against existing providers. The business is now looking to be a central part of your data and digital development plan. Adobe recruited former Informatica CEO Anil Chakravarthy to lead its customer experience team.

SAP

SAP’s 2021 strategy is to shift its clients to the cloud quicker and create a single data model. SAP puts business software and framework in full power to facilitate a holistic transformation of their business. By allowing our customers to seamlessly design, create or construct new business models with agility and speed.

To do this, all of their leading solutions will adopt a cloud platform and share one semantic data model, one AI and analytics layer, one common security and authorization model. These business application services share a cloud platform powered by SAP HANA.

Oracle

Oracle has the infrastructure, platform, and database that is increasingly autonomous. Despite its footprint on IaaS and PaaS, Oracle is mostly a software provider when it comes to the cloud. With the addition of NetSuite, the company can cover small, medium-sized, and large enterprises.

While Oracle came to IaaS in 2020 as an afterthought, it had an eventful second half of the year. Oracle has landed Zoom as a reference customer for its cloud and is seeing momentum. Oracle is also in the process of becoming TikTok’s leading technology partner.

SaaS will power up Oracle’s cloud efforts. It is unclear whether Oracle’s bet on Generation 2 Cloud Infrastructure will pay off. But, its enterprise resource planning, human capital management, supply chain, sales and service, marketing, and NetSuite clouds are going to keep it a cutthroat competitor.

Talk To Us

Get end-to-end web application development solutions for an unparalleled back-end and front-end experience. With our top-of-the-line technology expertise, We have been entitled to prestigious titles and awards as the best software development company that caters to industries and clients worldwide.